Optimistic Forecasts for 2025 by Goldman Sachs Economists

December 31, 2024 - 18:37

Goldman Sachs economists made a handful of predictions for 2025 that imply a solid foundation for stocks and the economy in the coming year. Among the key forecasts is the expectation of interest rate cuts, which could stimulate consumer spending and investment. This monetary easing is anticipated to create a more favorable environment for businesses, potentially leading to increased hiring and economic growth.

In addition to rate cuts, the economists highlighted a robust employment landscape. With unemployment rates remaining low, more individuals are expected to have disposable income, further driving demand for goods and services. This positive job market is projected to contribute to sustained economic momentum.

Moreover, the economists foresee a decline in prices, which could alleviate inflationary pressures that have been a concern in recent years. Lower prices would not only benefit consumers but also enhance purchasing power, contributing to overall economic stability. These factors combined paint a bullish picture for 2025, suggesting a year of growth and opportunity in various sectors.

MORE NEWS

January 30, 2026 - 02:26

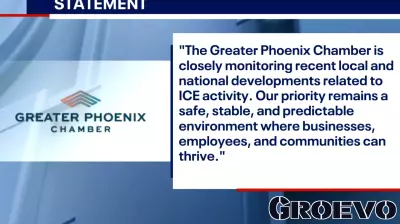

Phoenix businesses join nationwide 'ICE Out' to protest immigration raidsPhoenix, AZ – In a powerful display of solidarity, numerous local businesses throughout the Valley plan to cease operations this Friday, January 30th. This coordinated action forms part of a...

January 29, 2026 - 22:58

A Business Owner Is Getting Divorced, Asks Dave Ramsey If He'll Lose The Business. 'She's Actually 98% Owner Of The Business And I'm 2% Owner'A Texas entrepreneur is confronting a devastating double loss: his marriage and potentially the business he operates. Despite being the primary operator since 2021, the man, identified as Manny,...

January 29, 2026 - 03:17

TeslaTesla`s fourth-quarter financial results revealed a significant downturn, marking a difficult close to what has been the automaker`s most challenging year since achieving consistent profitability....

January 28, 2026 - 00:49

Lululemon cuts 100 customer service jobs amid quality complaintsThe athleisure giant Lululemon has confirmed a reduction of approximately 100 customer service positions across North America. The move comes during a period of heightened scrutiny over product...